This article was prepared to be used as an aid in setting up Vendor posting

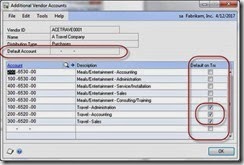

accounts. Purchasing Series > Cards > Vendor (Accounts Button)

Under Purchases ellipses button (circled above)

About Vendor Accounts The accounts entered on a vendor card are used to default on to a transaction. Cash is always defaulted from the Checkbook for this installation. If you do not have an account specified on the Vendor Account Maintenance, the system looks to the company posting account defaults from the Posting Accounts Setup window (below). You will notice that not every account on the Posting Accounts Setup window appears on the Vendor Account Maintenance

window. Administration Series > Setup > Posting > Posting Accounts

The accounts listed individually on the Vendor Account Maintenance window should not be the same as the accounts on the Posting Accounts Setup. Leave the Vendor Account Maintenance screen blank for otherwise matching accounts. For instance, if you have one Accounts Payable account, do not enter this account at the vendor level. Enter it at the company level in the Posting Accounts Setup window. The only accounts entered directly to the card are exceptions to any company defaults. If no default is found at the vendor level or the company level, the transaction account is left blank and the user has to enter the account in order to post the transaction. I recommend not using a default purchases account at the company level unless it is a suspense account.

Additional Vendor Accounts These are accounts that can be added as purchase accounts (the debit part of a payable transaction). You can enter an unlimited number of accounts here. Any accounts you mark ‘Default on Trx’ for appear in the transaction distribution window during transaction entry. No dollar amount will default into these accounts, nor is one required for posting. In other words, you do not have to use each of the accounts that default onto the transaction. If you put an account in the Purchases field on the Vendor Account Maintenance window or the Posting Accounts Setup window, then the full dollar amount of the purchase will default into this account. When in the distribution window, selecting the lookup button next to the account number field will display a lookup including only the accounts that have been added to the Additional Vendor Accounts window. The full list of accounts is also available, but this shorter list is displayed first. This feature is very helpful if a vendor has several accounts that are used in a single transaction. Good examples of this include employee expense accounts, credit card bills, travel agent fees, hotel bills, et cetera.

Accounts Payable The default account that Payable amounts for this vendor will be posted to. DR Purchases CR Accounts Payable

Terms Discounts Available Terms discounts might be offered to you as an incentive to pay your account balances before the due date. In order to use this account as a default the ‘Track Discounts Available in General Ledger’ must be selected on the Payables Setup window. This is a liability account typically included in the Accounts Payable category. DR Purchases CR Terms Discount Available CR Accounts Payable

Terms Discount Taken Terms discounts might be offered to you as an incentive to pay your account balances before the due date. In order to use this account as a default the ‘Track Discounts Available in General Ledger’ must be selected on the Payables Setup window. This is typically an income account. DR Accounts Payable DR Terms Discount Available CR Terms Discount Taken CR Cash

Finance Charges If finance charges are assessed by your vendor, this is the account that will be debited. This is typically an expense account. DR Finance Charges CR Accounts Payable

Purchases This account holds the amount of the purchase made from this vendor. This is typically an expense account, but can also be an asset account (inventory, fixed assets, pre-paids, et cetera). Only use this account if it is used nearly 100% of the time for this particular vendor. DR Purchases CR Accounts Payable

Trade Discount This account is used when the vendor gives you an amount off of the entire invoice rather than an amount tied to a specific item. This decreases the balance of the invoice. This is typically posted to a expense account or a ‘contra’ expense account. I do not see this used frequently. DR Purchases CR Trade Discount CR Accounts Payable

Miscellaneous This account is used for miscellaneous amounts on a vendor invoice like handling charges that you want to track separately from the purchase. This increases the balance due on the invoice and is typically an expense account DR Miscellaneous CR Accounts Payable

Freight This account is used to record the amount charged by the vendor for freight. This increases the balance due on the invoice and is typically an expense account. DR Freight CR Accounts Payable

Tax This account is used to record the amount of sales tax charged by the vendor. This increases the balance due on the invoice and is typically an expense account. The only time I see this field used is when a company needs to accumulate ‘use’ tax, otherwise the entire amount due the vendor (including tax) is included in the Purchases amount. DR Tax CR Accounts Payable

Writeoffs This account is used when you do not pay the full balance owed the vendor and never intend to. The balance due is written off to take it from your accounts payable accounts. This is typically a contra expense account, or a credit to the original account that was debited when the vendor invoice was recorded. DR Accounts Payable CR Writeoffs

Accrued Purchases This account is used when you receive items from the vendor but have not yet received the vendor’s invoice for the items. It acts as a temporary holding account for what will eventually be the account payable to the vendor. This is typically used in Purchase Order Receipt and is most likely associated with inventory or large purchases that require separate delivery processing. This is typically a liability account included with the Accounts Payable category. The balance is cleared out when the vendor’s invoice is received. DR Purchases CR Accrued Purchases

Purchase Price Variance This account is used for the price variance between a shipment unit cost and an invoice unit cost when posting an invoice receipt for a non-inventoried item using the Purchasing Invoice Entry window. DR Accrued Purchases DR Purchase Price Variance CR Accounts Payable

For example: a non-inventory item was received at $40

DR Purchases $40

CR Accrued Purchases $40

the vendor invoiced the item at $45

DR Accrued Purchases $40

DR Purchase Price Variance $5

CR Accounts Payable $45

Until next time!

Leslie

No comments:

Post a Comment