I’ve been getting quite a few calls lately about how to get the new 2014 tax tables if they can no longer get them from Microsoft. These folks are on versions 9 or 10, so they are out of luck on the download. Scandalous though it may be to remain on an unsupported version, they still have to update their tax tables. Fortunately, you can easily change the tax rates yourself using Dynamics GP.

After applying the current tax tables (as of 01-16-2014), this is what the windows look like:

FICAM 2014

Administration | Setup | System | Payroll Tax

Enter or select the Tax Code

Push the [Filing Status] button

Scroll to Filing Status NA

Push the [Tables] button

FICAS 2014

Enter or select the Tax Code

Push the [Filing Status] button

Scroll to Filing Status NA

Push the [Tables] button

EFICM

Administration | Setup | System | Payroll Tax

Enter or select the Tax Code

Push the [Filing Status] button

Scroll to Filing Status NA

Push the [Tables] button

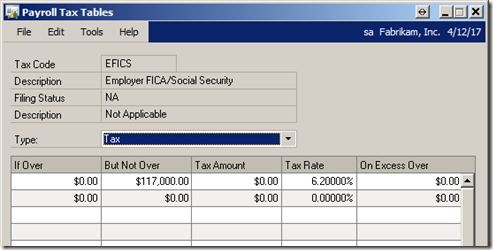

EFICS 2014

Administration | Setup | System | Payroll TaxEnter or select the Tax Code

Push the [Filing Status] button

Scroll to Filing Status NA

Push the [Tables] button

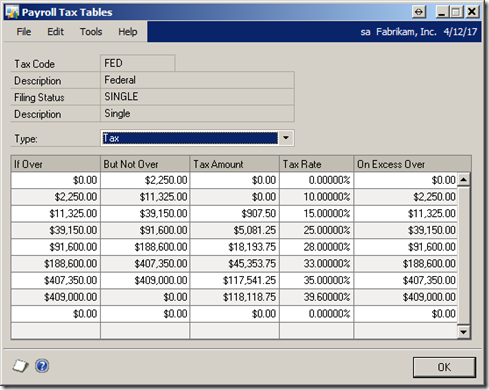

FED SINGLE 2014

Administration | Setup | System | Payroll TaxEnter or select the Tax Code

Push the [Filing Status] button

Scroll to Filing Status SINGLE

Push the [Tables] button

FED MAR 2014

Administration | Setup | System | Payroll TaxEnter or select the Tax Code

Push the [Filing Status] button

Scroll to Filing Status MAR

Push the [Tables] button

FED NRA 2014

Administration | Setup | System | Payroll TaxEnter or select the Tax Code

Push the [Filing Status] button

Scroll to Filing Status NRA

Push the [Tables] button

If you can’t read the screen shots, I also have the numbers for both the 2014 and 2013 in the tables below:

FICAM 2014

Administration | Setup | System | Payroll TaxEnter or select the Tax Code

Push the [Filing Status] button

Scroll to Filing Status NA

Push the [Tables] button

| If Over | But Not Over | Tax Amount | Tax Rate | On Excess Over |

| $0.00 | $200,000 | $0.00 | 1.45% | $0.00 |

| $200,000 | $0.00 | $0.00 | 2.35% | $0.00 |

| $0.00 | $0.00 | $0.00 | 0.00% | $0.00 |

FICAS 2014

Administration | Setup | System | Payroll TaxEnter or select the Tax Code

Push the [Filing Status] button

Scroll to Filing Status NA

Push the [Tables] button

| If Over | But Not Over | Tax Amount | Tax Rate | On Excess Over |

| $0.00 | $117,000 | $0.00 | 6.20% | $0.00 |

| $0.00 | $0.00 | $0.00 | 0.00% | $0.00 |

EFICM 2014

Administration | Setup | System | Payroll TaxEnter or select the Tax Code

Push the [Filing Status] button

Scroll to Filing Status NA

Push the [Tables] button

| If Over | But Not Over | Tax Amount | Tax Rate | On Excess Over |

| $0.00 | $0.00 | $0.00 | 1.45% | $0.00 |

| $0.00 | $0.00 | $0.00 | 0.00% | $0.00 |

EFICS 2014

Administration | Setup | System | Payroll TaxEnter or select the Tax Code

Push the [Filing Status] button

Scroll to Filing Status NA

Push the [Tables] button

| If Over | But Not Over | Tax Amount | Tax Rate | On Excess Over |

| $0.00 | $117,000 | $0.00 | 6.20% | $0.00 |

| $0.00 | $0.00 | $0.00 | 0.00% | $0.00 |

FED SINGLE 2014

Administration | Setup | System | Payroll TaxEnter or select the Tax Code

Push the [Filing Status] button

Scroll to Filing Status SINGLE

Push the [Tables] button

| If Over | But Not Over | Tax Amount | Tax Rate | On Excess Over |

| $0.00 | $2,250.00 | $0.00 | 0.00% | $0.00 |

| $2,250.00 | $11,325.00 | $0.00 | 10.00% | $2,250.00 |

| $11,325.00 | $39,150.00 | $907.50 | 15.00% | $11,325.00 |

| $39,150.00 | $91,600.00 | $5,081.25 | 25.00% | $39,150.00 |

| $91,600.00 | $188,600.00 | $18,193.75 | 28.00% | $91,600.00 |

| $188,600.00 | $407,350.00 | $45,353.75 | 33.00% | $188,600.00 |

| $407,350.00 | $409,000.00 | $117,541.25 | 35.00% | $407,350.00 |

| $409,000.00 | $0.00 | $118,118.75 | 39.60% | $409,000.00 |

| $0.00 | $0.00 | $0.00 | 0.00% | $0.00 |

FED MAR 2014

Administration | Setup | System | Payroll TaxEnter or select the Tax Code

Push the [Filing Status] button

Scroll to Filing Status MAR

Push the [Tables] button

| If Over | But Not Over | Tax Amount | Tax Rate | On Excess Over |

| $0.00 | $8,450.00 | $0.00 | 0.00% | $0.00 |

| $8,450.00 | $26,600.00 | $0.00 | 10.00% | $8,450.00 |

| $26,600.00 | $82,250.00 | $1,815.00 | 15.00% | $26,600.00 |

| $82,250.00 | $157,300.00 | $10,162.50 | 25.00% | $82,250.00 |

| $157,300.00 | $188,600.00 | $28,925.00 | 28.00% | $157,300.00 |

| $235,300.00 | $413,550.00 | $50,765.00 | 33.00% | $235,300.00 |

| $413,550.00 | $466,050.00 | $109,587.50 | 35.00% | $413,550.00 |

| $466,050.00 | $0.00 | $127,962.50 | 39.60% | $466,050.00 |

| $0.00 | $0.00 | $0.00 | 0.00% | $0.00 |

FED NRA 2014

Administration | Setup | System | Payroll TaxEnter or select the Tax Code

Push the [Filing Status] button

Scroll to Filing Status NRA

Push the [Tables] button

| If Over | But Not Over | Tax Amount | Tax Rate | On Excess Over |

| $0.00 | $9,075.00 | $0.00 | 10.00% | $0.00 |

| $9,075.00 | $36,900.00 | $907.50 | 15.00% | $9075.00 |

| $36,900.00 | $89,350.00 | $5,081.25 | 25.00% | $36,900.00 |

| $89,350.00 | $186,350.00 | $18,193.75 | 28.00% | $89,350.00 |

| $186,350.00 | $405,100.00 | $45,353.75 | 33.00% | $186,350.00 |

| $405,100.00 | $406,750.00 | $117,541.25 | 35.00% | $405,100.00 |

| $406,750.00 | $0.00 | $118,118.75 | 39.60% | $406,750.00 |

| $0.00 | $0.00 | $0.00 | 0.00% | $0.00 |

Now for the 2013 Tax Tables:

FICAM 2013

Administration | Setup | System | Payroll TaxEnter or select the Tax Code

Push the [Filing Status] button

Scroll to Filing Status NA

Push the [Tables] button

| If Over | But Not Over | Tax Amount | Tax Rate | On Excess Over |

| $0.00 | $200,000 | $0.00 | 1.45% | $0.00 |

| $200,000 | $0.00 | $0.00 | 2.35% | $0.00 |

| $0.00 | $0.00 | $0.00 | 0.00% | $0.00 |

FICAS 2013

Administration | Setup | System | Payroll TaxEnter or select the Tax Code

Push the [Filing Status] button

Scroll to Filing Status NA

Push the [Tables] button

| If Over | But Not Over | Tax Amount | Tax Rate | On Excess Over |

| $0.00 | $113,700 | $0.00 | 6.20% | $0.00 |

| $0.00 | $0.00 | $0.00 | 0.00% | $0.00 |

EFICM 2013

Administration | Setup | System | Payroll TaxEnter or select the Tax Code

Push the [Filing Status] button

Scroll to Filing Status NA

Push the [Tables] button

| If Over | But Not Over | Tax Amount | Tax Rate | On Excess Over |

| $0.00 | $0.00 | $0.00 | 1.45% | $0.00 |

| $0.00 | $0.00 | $0.00 | 0.00% | $0.00 |

EFICS 2013

Administration | Setup | System | Payroll TaxEnter or select the Tax Code

Push the [Filing Status] button

Scroll to Filing Status NA

Push the [Tables] button

| If Over | But Not Over | Tax Amount | Tax Rate | On Excess Over |

| $0.00 | $113,700 | $0.00 | 6.20% | $0.00 |

| $0.00 | $0.00 | $0.00 | 0.00% | $0.00 |

FED SINGLE 2013

Administration | Setup | System | Payroll TaxEnter or select the Tax Code

Push the [Filing Status] button

Scroll to Filing Status SINGLE

Push the [Tables] button

| If Over | But Not Over | Tax Amount | Tax Rate | On Excess Over |

| $0.00 | $2,200.00 | $0.00 | 0.00% | $0.00 |

| $2,200.00 | $11,125.00 | $0.00 | 10.00% | $2,200.00 |

| $11,125.00 | $38,450.00 | $892.50 | 15.00% | $11,125.00 |

| $38,450.00 | $90,050.00 | $4,991.25 | 25.00% | $38,450.00 |

| $90,050.00 | $185,450.00 | $17,891.25 | 28.00% | $90,050.00 |

| $185,450.00 | $400,550.00 | $44,603.25 | 33.00% | $185,450.00 |

| $400,550.00 | $402,200.00 | $115,586.25 | 35.00% | $400,550.00 |

| $402,200.00 | $0.00 | $116,163.75 | 39.60% | $402,200.00 |

| $0.00 | $0.00 | $0.00 | 0.00% | $0.00 |

FED MAR 2013

Administration | Setup | System | Payroll TaxEnter or select the Tax Code

Push the [Filing Status] button

Scroll to Filing Status MAR

Push the [Tables] button

| If Over | But Not Over | Tax Amount | Tax Rate | On Excess Over |

| $0.00 | $8,300.00 | $0.00 | 0.00% | $0.00 |

| $8,300.00 | $26,150.00 | $0.00 | 10.00% | $8,300.00 |

| $26,150.00 | $80,800.00 | $1,785.00 | 15.00% | $26,150.00 |

| $80,800.00 | $154,700.00 | $9,982.50 | 25.00% | $80,800.00 |

| $154,700.00 | $231,350.00 | $28,457.50 | 28.00% | $154,700.00 |

| $231,350.00 | $406,650.00 | $49,919.50 | 33.00% | $231,350.00 |

| $406,650.00 | $458,300.00 | $107,768.50 | 35.00% | $406,650.00 |

| $458,300.00 | $0.00 | $125,846.00 | 39.60% | $458,300.00 |

| $0.00 | $0.00 | $0.00 | 0.00% | $0.00 |

FED NRA 2013

Administration | Setup | System | Payroll TaxEnter or select the Tax Code

Push the [Filing Status] button

Scroll to Filing Status NRA

Push the [Tables] button

| If Over | But Not Over | Tax Amount | Tax Rate | On Excess Over |

| $0.00 | $8,925.00 | $0.00 | 10.00% | $0.00 |

| $8,925.00 | $36,250.00 | $892.50 | 15.00% | $9075.00 |

| $36,250.00 | $87,850.00 | $4,991.25 | 25.00% | $36,900.00 |

| $87,850.00 | $183,250.00 | $17,891.25 | 28.00% | $89,350.00 |

| $183,250.00 | $398,350.00 | $44,603.25 | 33.00% | $186,350.00 |

| $398,350.00 | $400,000.00 | $115,586.25 | 35.00% | $405,100.00 |

| $400,000.00 | $0.00 | $116,163.75 | 39.60% | $406,750.00 |

| $0.00 | $0.00 | $0.00 | 0.00% | $0.00 |

That should do it!

Until next post

Leslie

Nice post i like it. the table of payroll tax have great information about the payroll system.

ReplyDeleteMy name is Jimmie and I'm a payroll specialist in Canada. Thank you for providing this blog for the employee like us.

ReplyDeleteRegard

Jimmie Menon

It will be very helpful for employee.Payroll processing consultants

ReplyDeleteI found it when I was looking for a different sort of information but I am very interested in the article, It is nice to read such kind of good posts I like your work keep it up!

ReplyDeletePayroll processing companies